Deciding on strengthening your dream house you’ve been design on your own direct for decades? If you find yourself safe going enhance sleeves, getting a proprietor creator are going to be cost effective.

Becoming a holder-creator form significant discounts can be made to the work and you may material, when you find yourself placing your on the driver’s chair having command over the brand new accomplished device. Yes this may seem like the best of one another planets, nevertheless the best success of your brand-new house generate will depend on your own experience and sense – we can’t all become Bob the Builder after all.

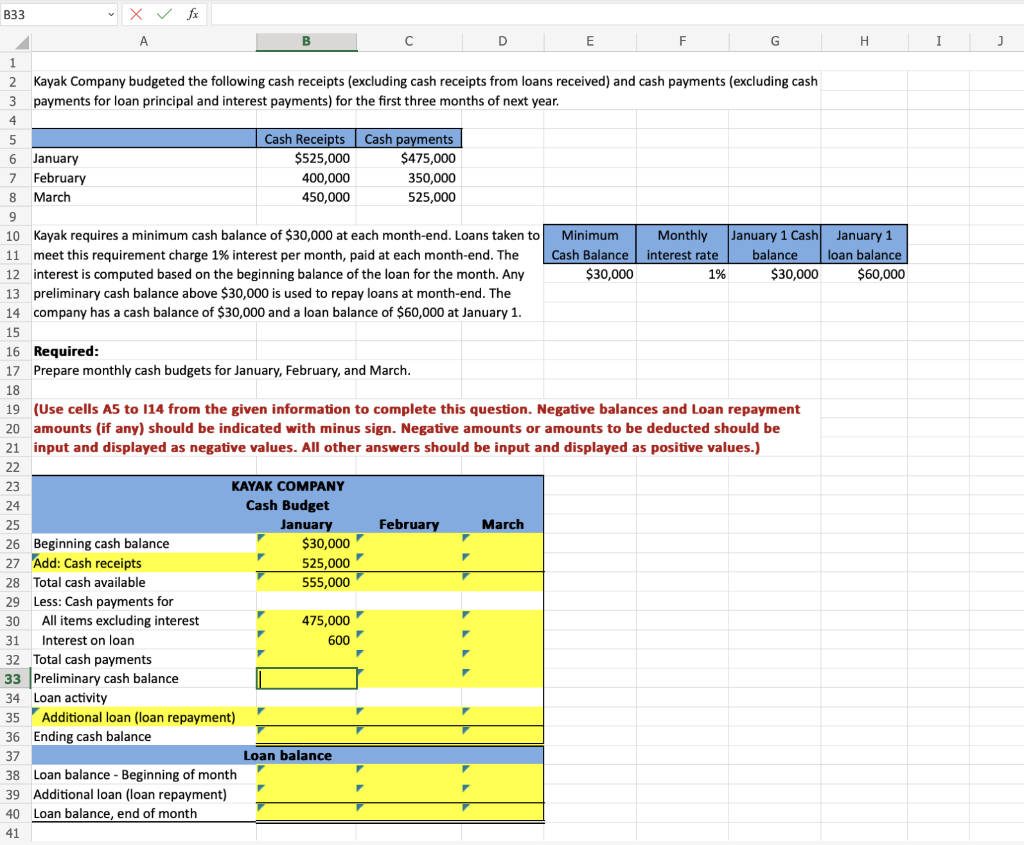

What is a holder builder construction financing

Holder creator build financing are specially geared to Australians seeking to create their unique home otherwise renovate a preexisting hold. These types of loans vary from antique mortgages as the as opposed to choosing the financing in one go, the lending company releases the mortgage inside stages and you may pays the fresh creator truly with advances costs.

A serious advantage on old-fashioned lenders is through owner builder design funds you pay attract-only instalments for the currency you use. Proprietor creator construction fund supply interest-just cost possibilities from inside the make period, just before reverting to help you a basic principal and appeal (P&I) loan post-framework.

Generally regarding thumb, essentially Australian loan providers try old-fashioned with regards to bringing home fund to owner developers. For the reason that of the a lot more danger of dealing with a lengthy-name opportunity on conclusion along with a resources.

Managing a funds in itself was a complicated and much time-label activity – one bout of Huge Designs‘ create inform you that it. If you possess the feel needed and eventually committed offered to complete the job, proprietor builder money are going to be a handy treatment for accessibility finance and you can leverage.

Ft conditions from: an excellent $eight hundred,000 loan amount, changeable, repaired, dominating and you may appeal (P&I) lenders having an enthusiastic LVR (loan-to-value) proportion of at least 80%. not, the fresh Evaluate Family Loans‘ table enables calculations are made on parameters as chosen and you may enter in because of the user. Specific facts could be designated given that marketed, looked otherwise paid that will are available plainly about tables irrespective of their properties. All issues commonly record new LVR with the tool and you will rate which can be obviously blogged into unit provider’s website. Monthly repayments, as the feet criteria was changed of the representative, depends into the selected products‘ said pricing and you can determined because of the loan amount, fees type of, financing label and you can LVR once the input by the user/your. *Brand new Review speed is based on good $150,000 mortgage more than 25 years. Warning: it comparison rates holds true simply for this situation that will not were all of the fees and you may charge. Other terminology, charge or other mortgage numbers might result during the another evaluation rate. Prices correct since . Have a look at disclaimer.

Framework loan values

In terms of your own manager builder framework home loan, per framework stage is essential so you’re able to receiving funds to the create. Per stage is actually analyzed by the bank earlier releases funds for another phase to go-ahead. The release of cash in your stead is named a good draw-upon your loan.

Repairing kitchen cabinets, appliances, bathroom and you will bathroom all are during the. Plumbing system and you will electrics are carried out. You reside plastered and coated.

To-be a proprietor builder

Regarding strengthening your own house, it can help to know the principles and you can legislation first. For each and every state and $800 loan today Gunbarrel CO you will territory may differ, so for the following example we are going to use Queensland.

According to value of the work, in the Queensland when you need to undertake or coordinate people domestic renovations appreciated during the $11,000 or even more whether it be to create an alternate house otherwise redesign a keen current that you need to see a manager creator enable.